Crypto Basics: What Is a Stablecoin, How It Works

Published by: aelf, December 13, 2024

The cryptocurrency world is known for its exciting potential—and its wild price swings. Stablecoins present the benefits of crypto without the rollercoaster of emotions; this class of digital assets offers relative stability (as the name suggests) in the often-turbulent crypto seas, and they have climbed the ranks of mainstream adoption quicker than other cryptocurrencies.

What Are Stablecoins?

Stablecoins can claim to be less volatile than other crypto because they maintain a peg to stable assets, like the US dollar, the Euro, or even gold. Unlike Bitcoin, Ethereum, or other altcoins, which can fluctuate dramatically in value, stablecoins aim to maintain a consistent price in Web3 transactions.

This makes them ideal for everyday transactions, cross-border payments, and accessing decentralised finance (DeFi) applications.

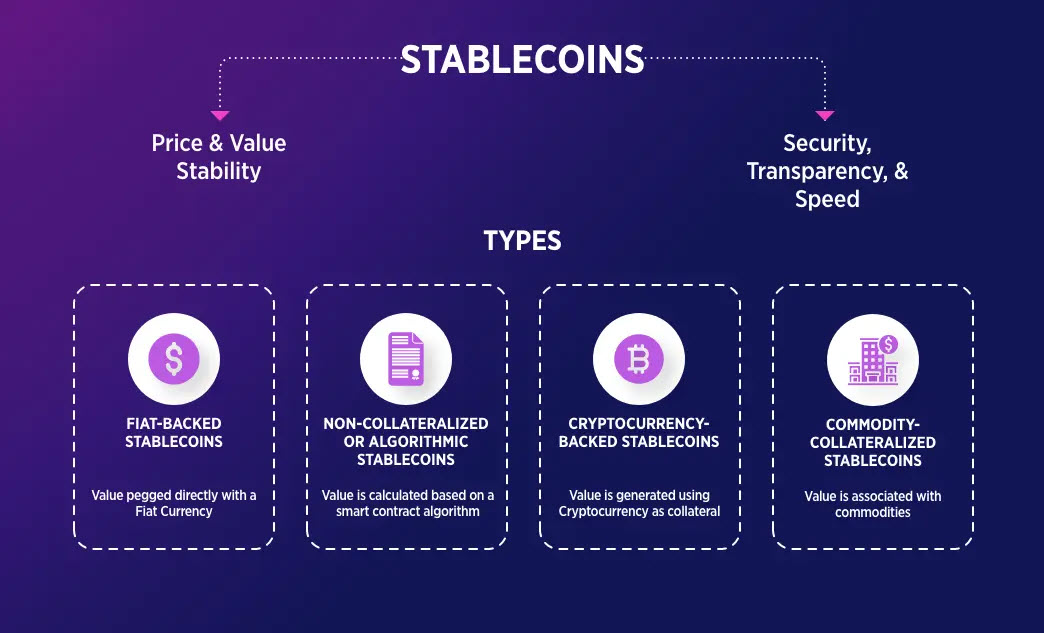

Types of Stablecoins

Stablecoins achieve their stability through different mechanisms. Here’s a quick overview.

| Stablecoin Type | Description | Examples |

| Fiat-collateralised | Backed by fiat currencies held in reserve by the issuer | USDT, USDC, PYUSD |

| Crypto-collateralised | Backed by other cryptocurrencies, often over-collateralised to account for price fluctuations | DAI, MIM |

| Algorithmic | Use algorithms and smart contracts to maintain price stability without collateral | FRAX, UST |

How These Stablecoin Types Work, Explained

Fiat-Collateralised

These stablecoins maintain their peg by holding an equivalent amount of fiat currency in reserve. For example, every Tether (USDT) in circulation is supposedly backed by one US dollar held by Tether Limited.

Crypto-Collateralised

These stablecoins are backed by reserves of other cryptocurrencies. To account for the volatility of crypto, they are often over-collateralised. For instance, DAI is backed by a mix of cryptocurrencies like Ethereum, which are held in smart contracts.

Algorithmic

These stablecoins rely on algorithms and smart contracts to manage their supply and maintain price stability. They don’t rely on collateral but use mechanisms like minting and burning tokens to adjust to market demand.

What’s the Difference Between Stablecoins and Bitcoin?

While both stablecoins and Bitcoin fall under the cryptocurrency umbrella, they serve different purposes:

- Volatility: Bitcoin and other non-stablecoins are known for their price volatility, which can make it a risky investment and less suitable for everyday transactions. Stablecoins, on the other hand, attempt to maintain price stability, making them more practical for real-world payments and other use cases.

- Purpose: Bitcoin was designed as a decentralised digital currency, a store of value, and a medium of exchange. Stablecoins primarily focus on facilitating transactions, providing access to DeFi services, and offering a stable alternative to volatile cryptocurrencies.

- Underlying asset: Bitcoin’s value is determined by the Web3 and crypto market’s supply and demand. Stablecoins derive their value from an underlying asset, such as a fiat currency or another cryptocurrency.

Benefits of Owning Stablecoins

Stablecoin users would be hard-pressed to find all-time highs, but they do enjoy certain advantages in both the Web2 and Web3 spaces.

- Relative stability: Price fluctuations or sudden price dips as seen with non-stablecoins and meme coins would no longer be top of mind, as stablecoins offer a predictable store of value

- Faster and cheaper transactions: Compared to traditional banking systems, stablecoin transactions are often faster and have lower fees

- Increased accessibility: Stablecoins can provide access to financial services for people who are unbanked or underbanked

- DeFi applications: Stablecoins are essential for participating in decentralised finance, allowing users to unlock more value with their digital assets rather than just HODLing them

Stablecoins Are Already Being Used in the Real World

Stablecoins are quickly moving beyond the realm of theory and into real-world applications.

Payment Integration

Major players like Visa and PayPal have already embraced stablecoins. Visa, for example, has partnered with Crypto.com to settle transactions using USDC, demonstrating the growing acceptance of stablecoins in traditional finance.

Cross-Border Transactions

Stablecoins are streamlining cross-border payments, offering a faster and more cost-effective alternative to traditional remittance services. Companies like Stellar and Ripple are leveraging blockchain technology and stablecoins to facilitate seamless international transfers.

Real-World Purchases

You can increasingly use stablecoins to buy everyday goods and services. Platforms like BitPay and Flexa enable merchants to accept stablecoin payments, and Southeast Asia’s ride-hailing giant Grab has also enabled users to top up their wallets with USDT and UDSC, among other crypto choices.

Decentralised Finance (DeFi)

Stablecoins are the backbone of the DeFi ecosystem, powering lending platforms like Aave and Compound, where users can earn interest or borrow against their crypto holdings.

Latest Developments in Stablecoins: Ripple’s (XRP) RLUSD Is New Entrant

In December 2024, Ripple’s RLUSD stablecoin received approval from the New York State Department of Financial Services (NYDFS). This is a new feather in the cap for Ripple after hitting its all-time high and becoming the third-largest crypto by market cap. It enters a competitive stablecoin market that is currently dominated by Tether’s USDT and Circle’s USDC.

RLUSD is a fiat-collateralised stablecoin, meaning it is backed by reserves of traditional fiat currency, the US dollar. It is designed to operate on both the Ledger and Ethereum networks, offering versatility and interoperability. For a smooth rollout, Ripple has secured partnerships with various cryptocurrency exchanges, including Uphold, Bitstamp, and Bitso. Market makers like B2C2 and Keyrock will provide liquidity for the token, promoting stability and efficient trading.

In Closing

Mega corporations in the finance and tech industries are signaling their readiness with stablecoin payments. This leaves the option on the table for mass public consumers to ease into the world of Web3, beyond just crypto trading or staking.

With that said, stablecoins are not perfect. Under the hood of flashy profits and the draw of borderless convenience, the history books have spelled stablecoins’ controversies—USDT was notoriously depegged from the dollar in 2022, and lawmakers have bemoaned that stablecoins’ peg to stable assets is not always convincing.

If stablecoins can continue to win over trust, this time from the regular Joes and Janes on the street, it could prove to leave traditional financial systems in the dust.