Staking, Borrowing & Yield Farming

Staking, borrowing, and yield farming are three popular concepts in the world of decentralized finance (DeFi) that have gained significant attention and adoption in recent years.

These practices allow individuals to earn passive income, borrow assets, and maximize their returns on investments within the DeFi ecosystem. In this comprehensive explanation, we will delve into each concept individually, discussing their functionalities, benefits, risks, and how they contribute to the overall DeFi landscape.

Staking:

Staking refers to the process of holding and validating cryptocurrencies in a blockchain network to support its operations. It involves locking up a certain amount of tokens as collateral to participate in the consensus mechanism of a proof-of-stake (PoS) blockchain. By doing so, stakers contribute to network security and consensus by validating transactions and creating new blocks.

When users stake their tokens, they are often rewarded with additional tokens as an incentive for their contribution to the network. These rewards can be in the form of newly minted tokens or transaction fees generated within the network. The amount of rewards received is typically proportional to the number of tokens staked.

Staking offers several benefits to participants. Firstly, it allows individuals to earn passive income by simply holding and staking their tokens. This is particularly attractive for long-term investors who want to generate additional returns on their holdings. Secondly, staking helps secure the blockchain network by ensuring that a certain number of tokens are locked up as collateral, discouraging malicious actors from attempting attacks on the network. Lastly, staking can also provide governance rights within a blockchain ecosystem, allowing stakers to participate in decision-making processes such as protocol upgrades or voting on proposals.

However, staking also carries certain risks. One major risk is the potential loss of funds if the underlying blockchain experiences a technical vulnerability or suffers from a malicious attack. Additionally, stakers may face liquidity constraints since their tokens are locked up for a specific period or until certain conditions are met. This lack of liquidity can limit the ability to sell or trade the staked tokens in case of price fluctuations or investment opportunities.

Borrowing:

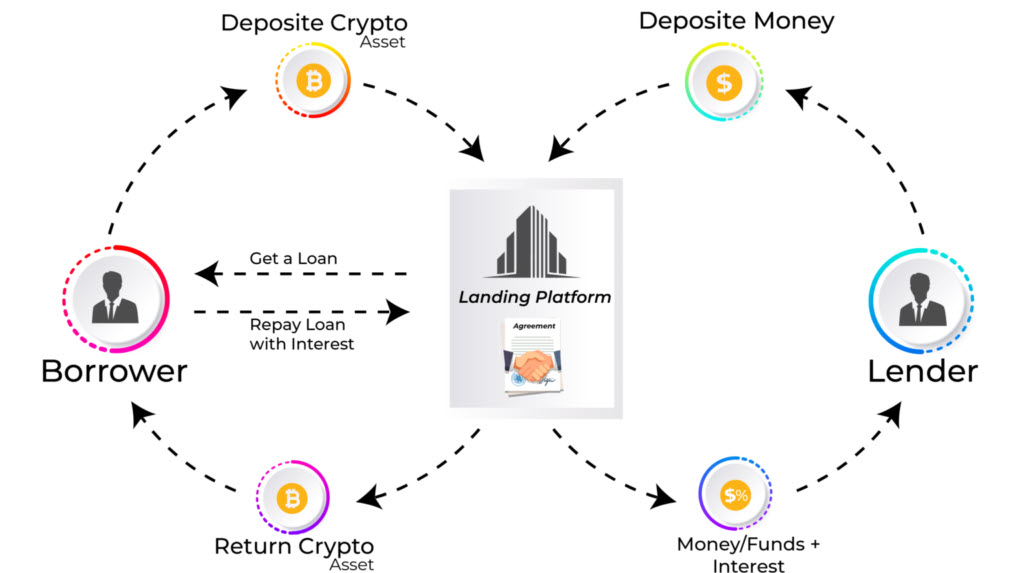

Borrowing in the DeFi space refers to the act of obtaining assets, typically cryptocurrencies, by pledging collateral. Unlike traditional financial systems where borrowing is facilitated by intermediaries such as banks, DeFi borrowing is decentralized and operates through smart contracts on blockchain platforms.

To borrow funds in DeFi, users need to lock up a certain amount of collateral, usually in the form of cryptocurrencies, which serves as security for the loan. The value of the collateral must exceed the borrowed amount by a predetermined ratio known as the loan-to-value (LTV) ratio. The LTV ratio ensures that lenders are protected from potential default risks.

Once the collateral is locked, borrowers can access the borrowed funds and use them for various purposes such as trading, investing, or even for personal expenses. Borrowers are typically required to pay interest on the borrowed amount, which is determined by market dynamics and can vary depending on supply and demand conditions within the DeFi ecosystem.

DeFi borrowing offers several advantages over traditional borrowing systems. Firstly, it eliminates the need for intermediaries, reducing costs and increasing accessibility for individuals who may not have access to traditional banking services. Secondly, DeFi borrowing allows users to retain ownership of their collateral throughout the borrowing period, unlike traditional systems where collateral is often held by lenders. Lastly, DeFi borrowing enables individuals to access funds quickly and efficiently without going through lengthy approval processes.

However, there are also risks associated with DeFi borrowing. One significant risk is the potential liquidation of collateral if its value falls below a certain threshold known as the liquidation price. If this occurs, lenders may seize and sell off the collateral to recover their funds, potentially resulting in losses for borrowers. Additionally, borrowers may face risks associated with smart contract vulnerabilities or system failures, which could lead to the loss of their collateral or borrowed funds.

Yield Farming:

Yield farming, also known as liquidity mining, is a practice in DeFi where users provide liquidity to decentralized exchanges (DEXs) or lending platforms and earn rewards in return. It involves depositing funds into specific protocols or pools that require liquidity to facilitate trading or lending activities.

In yield farming, users typically deposit their assets into liquidity pools, which are smart contracts that enable the exchange of tokens within a decentralized marketplace. By providing liquidity to these pools, users earn rewards in the form of additional tokens or fees generated by the platform. The rewards earned can vary depending on factors such as the amount of liquidity provided, the duration of participation, and the overall demand for the platform’s services.

Yield farming offers several benefits to participants. Firstly, it allows individuals to earn additional income on their idle assets by simply providing liquidity to DeFi platforms. This can be particularly attractive for individuals who have excess funds sitting idle in their wallets. Secondly, yield farming provides an opportunity for users to participate in the growth of emerging DeFi projects and protocols by supporting their liquidity needs. Lastly, yield farming can also offer governance rights within a protocol, allowing participants to have a say in decision-making processes.

However, yield farming is not without risks. One significant risk is impermanent loss, which occurs when the value of deposited assets fluctuates significantly compared to other assets in the pool. This can result in a loss of value when withdrawing assets from the pool. Additionally, yield farming carries smart contract risks and vulnerabilities that could potentially lead to the loss of deposited assets. Furthermore, participants may face challenges in assessing the credibility and security of various DeFi platforms, as new projects emerge frequently.

In conclusion, staking, borrowing, and yield farming are three prominent practices within the DeFi ecosystem that offer individuals opportunities to earn passive income, access funds, and maximize returns on their investments. While these practices present attractive benefits, it is crucial for participants to understand the associated risks and conduct thorough research before engaging in any DeFi activities.

Consultation | 1 to 1.5 hours Price | $250